If you’re eyeing a chance to set up a powerful, pro-gun legacy that will embolden future generations, Texas Gun Rights Foundation would be deeply grateful for your assistance. Whether it’s gifts in the form of stocks, designating us as the beneficiary of your 401k, life insurance, retirement accounts, or even making a provision for us in your will — every bit of support can make a real difference!

To get the full scoop on these options, don’t hesitate to take a look through the various choices available. Remember, your support is not just about helping us, it’s about securing the Second Amendment rights for our children and grandchildren. And trust me, they’re going to need all the help they can get.

Gifting Appreciated Stock

Gifting Appreciated Stock

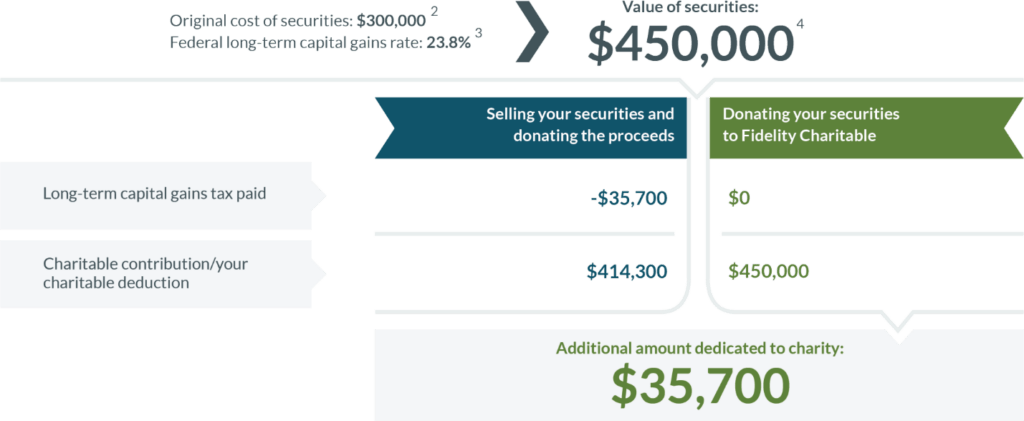

Make a bigger impact by donating long-term appreciated securities, including stock, bonds, and mutual funds, directly to Texas Gun Rights Foundation. Compared with donating cash, or selling your appreciated securities and contributing the after-tax proceeds, you may be able to automatically increase your gift and your tax deduction.

How does it work?

It’s simple and easy. When you donate stock to Texas Gun Rights Foundation, you’ll generally take a tax deduction for the full fair market value. And because you are donating stock, your contribution and tax deduction may instantly increase over 20%.1 Would you prefer to donate bonds or mutual funds? The same benefits apply.

A larger gift and a larger deduction

Consider this example of donating stock to Texas Gun Rights Foundation with a Giving Account at Fidelity Charitable:

1. This assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%, and that the donor originally planned to sell the stock and contribute the net proceeds (less the capital gains tax and Medicare surtax) to Texas Gun Rights Foundation.

2. Total Cost Basis of Shares is the amount of money you have invested in the shares of a particular fund or individual security. It represents the basic dollar amount that, when compared to the price at which you sell your shares, tells you how much of a capital gain or loss you have realized.

3. This assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%. This does not take into account state or local taxes, if any.

4. Amount of the proposed donation is the fair market value of the appreciated securities held more than one year that you are considering to donate.

Next Steps

We would be happy to answer any questions regarding charitable giving that you or your advisors may have. Feel free to contact us at no obligation.

(512) 774-5309

Or see contact form below.

Life Insurance Beneficiary

Life Insurance: Expand Your Charitable Reach

Life insurance is a tool with many purposes. Perhaps when your children were young, you purchased policies to provide them with financial protection. But if your situation has changed, you might be interested in one of the more satisfying uses for life insurance you no longer need—donating it to Texas Gun Rights Foundation so we can take our no-compromise, bare-knuckled tactics to defend the Second Amendment in the courtrooms.

A gift of life insurance has many perks:

Cost Efficient

You can make a significant gift even if your means are limited today. By making small premium payments each year, you can leave a sizable gift.

Tax Beneficial

For existing policies, you may receive an income tax charitable deduction if you itemize. For a new policy, with Texas Gun Rights Foundation as owner and beneficiary, premiums may be deductible.

Secure and Confidential

Life insurance is a contract and can’t be changed by heirs. If you make Texas Gun Rights Foundation policy owner and beneficiary, it’s not included in probate and remains confidential.

Helpful to Our Mission

Life insurance gives you a low-cost option to make a gift, helping you to make a bigger impact on our work than you may have thought possible.

3 Ways to Arrange a Life Insurance Gift

Give an Existing Policy

When you name Texas Gun Rights Foundation as the policy owner and beneficiary, you qualify for a federal income tax charitable deduction for the lower of the policy’s fair market value or your cost basis. For paid-up insurance, the fair market value is the cost of replacing the coverage with a new policy issued today based on the current age of the insured at the same face amount as the original policy.

If premiums are still payable on the policy, the fair market value is usually close to the cash surrender value. You may stipulate to us that you wish to no longer make future premium payments, allowing us to access the surrender value immediately for our cash needs.

An alternative, however, may be even more attractive. The policy can remain ours and will stay in force so that someday we receive the original face amount. You pledge to make yearly cash gifts to Texas Gun Rights Foundation, which we will use to pay the premiums. The gifts are deductible if you itemize, and the policy is thereby kept in force with pre-tax instead of after-tax dollars for a lower actual cost.

Retain Ownership of an Existing Policy and Name Us as a Beneficiary

If you would rather retain ownership of a policy for your own financial security or that of others, you have the following options:

- Name us as the sole or partial primary beneficiary of the policy, leaving any balance to your heirs. Because you retain ownership of the policy, you have the right to change the beneficiary at any time in any way you wish.

- Name Texas Gun Rights Foundation as the contingent beneficiary, so we receive the death benefits only if your primary beneficiary predeceases you.

- Create a separate trust named to receive the death benefits, with terms providing for the financial support for one or more named loved ones for a specific term of years or for life, after which the trust terminates, and its assets pass to Texas Gun Rights Foundation.

Purchase a New Policy for Future Charitable Gifts

In most states, you can enter into a new insurance contract with a qualified organization such as Texas Gun Rights Foundation as the beneficiary and owner of the policy.

Next Steps

We would be happy to answer any questions regarding charitable giving that you or your advisors may have. Feel free to contact us at no obligation.

(512) 774-5309

Or see contact form below.

Donate your IRA Retirement Account

Make the Most of Your Retirement Plan Assets

Reduce Taxes and Support Our Work

Did you know that retirement accounts are exposed to federal income taxes that could be as much as 37% upon your death? The good news is that these taxes can be eliminated or reduced through a carefully planned charitable gift.

Consider leaving your loved ones less heavily taxed assets and leaving your retirement plan assets to Texas Gun Rights Foundation to support our work. As a nonprofit organization, we are tax-exempt and will receive the full amount of what you designate to us from your plan. You can take advantage of this gift opportunity in several ways, illustrated below.

Retirement Plan Assets

3 Ways to Donate Your Retirement Account

List Texas Gun Rights Foundation as a beneficiary of your account.

The simplest way to leave the balance of a retirement account to Texas Gun Rights Foundation after your lifetime is to list Texas Gun Rights Foundation as the beneficiary on the form provided by your plan administrator. If you are married, your spouse must sign a written waiver.

Make Texas Gun Rights a contingent beneficiary.

If you prefer to make your spouse the primary beneficiary of your retirement account, you can name Texas Gun Rights Foundation as the contingent beneficiary. Want your children to benefit, too? Designate a percentage for Texas Gun Rights Foundation with the remainder for your children.

Give from your IRA.

If you are 70½ or older, you can give any amount up to $100,000 from your IRA directly to a qualified charity such as Texas Gun Rights Foundation without having to pay income taxes on the money. Beginning in the year you turn 73, you can use your gift to satisfy all or part of your required minimum distribution.

Example: Tax-Smart Planning

A longtime donor with a $1.5 million estate wants to leave Texas Gun Rights Foundation a gift valued at $750,000. They also want to leave something to their only daughter who is in the 32% federal income tax bracket. Take a look at the options.

Option 1: Our donor divides assets equally between the daughter and Texas Gun Rights Foundation.

|

Daughter |

Us |

|

| IRA |

$375,000 |

$375,000 |

| Other assets (house, securities, cash) |

$375,000 |

$375,000 |

| Federal income tax owed |

($120,000) |

($0) |

| Net amount to beneficiary after taxes |

$630,000 |

$750,000 |

Option 2: Our donor names Texas Gun Rights the beneficiary of retirement plan assets and leaves the daughter all other assets.

|

Daughter |

Us |

|

| IRA |

$0 |

$750,000 |

| Other assets (house, securities, cash) |

$750,000 |

$0 |

| Federal income tax owed |

($0) |

($0) |

| Net amount to beneficiary after taxes |

$750,000 |

$750,000 |

Next Steps

Contact your plan administrator to request their beneficiary form.

But if you would like to talk with us before marking Texas Gun Rights Foundation as a beneficiary, we would be happy to answer any questions that you may have. Feel free to contact us at no obligation:

(512) 774-5309

Or see contact form below.

Add Us to Your Will

Leave us in your will

Have you considered adding the Texas Gun Rights Foundation as a beneficiary in your will?

You know as well as anyone that the Second Amendment protects all of the rest of our constitutionally protected rights. Your legacy of support will help ensure the Second Amendment is protected for future generations with a tough-as-nails, no compromise pro-Second Amendment legal entity.

Your Last Will and Testament is the ultimate statement of what matters most to you — the people you love and the values and principles you hold dear.

That is why many freedom-loving Texans choose to include Texas Gun Rights Foundation in their estate planning.

This isn’t just an exercise for the wealthy. No bequest is too small. Every bequest is appreciated.

Each and every one of these gifts is a testament to our members’ love of individual liberty. Together, their collective strength serves as a bedrock for ensuring the Second Amendment stands as the biggest bulwark against tyranny!

If you are ready to include the Texas Gun Rights Foundation in your will, there are three simple ways to do so with sample language below

Sample Bequest Language

Scenario 1: Make a Simple Bequest

- Give a specific amount:

- “I give and bequeath to Texas Gun Rights Foundation, Inc of 200 S. Oakridge Dr Ste 101-327, Hudson Oaks, TX 76087 the sum of $_________, to be used as the organization determines.”

Scenario 2: Make a Percentage Bequest

- Give a percentage of your estate:

- “I give and bequeath to Texas Gun Rights Foundation, Inc of 200 S. Oakridge Dr Ste 101-327, Hudson Oaks, TX 76087 ___% of the total value of my estate to be used as the organization determines.”

Scenario 3: Make a Residual Bequest

- Give the remainder of your estate after you have provided for family members and other beneficiaries:

- “I give and bequeath to Texas Gun Rights Foundation, Inc of 200 S. Oakridge Dr Ste 101-327, Hudson Oaks, TX 76087 the rest, residue, and remainder residual of my estate, to be used as the organization determines.”

Next Steps

- Contact the institution that controls the asset for a change-of-beneficiary form. Many have the forms on their website available for download.

- Decide what amount of the account value you would like Texas Gun Rights Foundation to receive.

- Name North Texas Gun Rights Foundation, Inc. as the beneficiary.

- Return or submit the form as directed by the institution.

- Notify the beneficiaries so they can claim the proceeds at the appropriate time.

If you would like to talk with us before making a bequest, we would be happy to answer any questions that you may have. Feel free to contact us at no obligation:

(512) 774-5309

Or see contact form below.

Set-up an Endowment Fund

Endowments

A Never-Ending Legacy

Throughout our lifetime, most of us strive to make a difference in the lives of others, providing gifts to the people and causes we value. Wouldn’t it be nice to know that you could continue changing lives even after you are gone, creating a legacy of support for the causes most important to you? By creating an endowment with Texas Gun Rights Foundation—or adding to our existing endowment—you can give a gift that lasts forever.

How It Works

You give cash, securities, or other assets to Texas Gun Rights Foundation for a new or existing endowment.

Determine if your endowment will fund a specific program or service, or be given without restrictions—allowing Texas Gun Rights Foundation to direct the funds to our most critical needs.

We use a small portion of the fund to support our mission, and the balance remains invested to perpetuate the endowment.

Tip: You can use an endowment gift to honor someone important to you who appreciates the work we do. Consider designating your endowment in his or her name as a way to celebrate them.

Endowments

A Quick Example

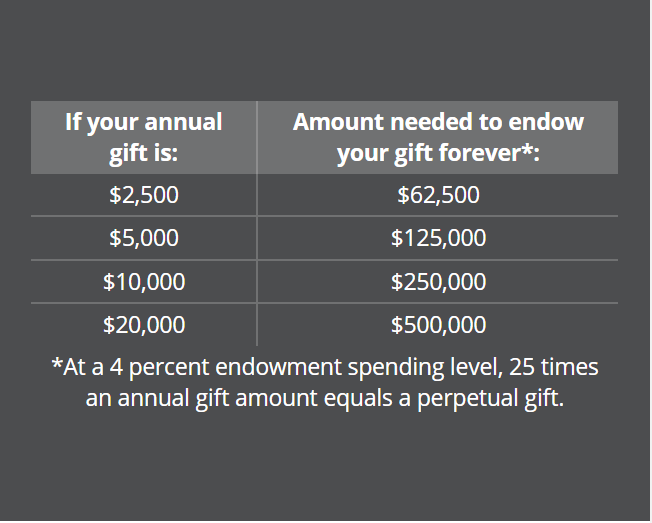

Sam wants to support our annual needs by sending a check for $5,000 to TEXAS GUN RIGHTS FOUNDATION each year. Sam qualifies for a $5,000 federal income tax charitable deduction (when itemizing taxes) each year the gift is made.

Sam would also like to leave a legacy and make a generous estate gift of $125,000 to establish a new endowment at TEXAS GUN RIGHTS FOUNDATION. This is the amount needed to ensure TEXAS GUN RIGHTS FOUNDATION continues to receive the annual $5,000 into the future. (See chart.)

Sam can support our current needs while living with annual gifts. After Sam’s lifetime, we use a portion of the endowment each year to fund our programs and reinvest the remainder, allowing it to grow and support annual payouts indefinitely.

Endowments

4 Key Steps to Creating an Endowed Gift

- Put It in Writing

If you are creating an endowment through your will or living trust and want it to be for a specific purpose, in most cases, you must explicitly state this. If you are establishing one during your lifetime, TEXAS GUN RIGHTS FOUNDATION will work with you to outline how you want it to be used. - Determine the Amount Needed

If you are creating an endowment today, TEXAS GUN RIGHTS FOUNDATION can inform you of the minimum amount required. If you intend to create one through your estate, TEXAS GUN RIGHTS FOUNDATION recommends you specify a set amount in your will or living trust, then include a provision directing your executor or personal representative to distribute more funds if needed, should minimums change. - Include Safety Language

Nationwide, millions of dollars directed to specific purposes sit idle in bank accounts because the funds are no longer needed. We encourage you to include a statement that allows TEXAS GUN RIGHTS FOUNDATION to redistribute the funds to another area if the original purpose is no longer necessary. - Lean on TEXAS GUN RIGHTS FOUNDATION for Help

We respect the personal nature of these decisions and have experience with the sensitive issues involved. TEXAS GUN RIGHTS FOUNDATION would be glad to consult with you to help ensure that your wishes are satisfied.

Next Steps

We would love to work with you to help you create a lasting legacy that honors your values for many years to come. Please contact us today to learn more about establishing an endowment with TEXAS GUN RIGHTS FOUNDATION.

(512) 774-5309

Or see contact form below.

Already left Texas Gun Rights Foundation in your Estate Plans?

We’re truly honored by your dedication to make protecting the Second Amendment a part of your enduring legacy and we want to express our deepest gratitude for your gift!

Kindly complete our non-binding letter of intent so we can send you our heartfelt appreciation, welcome you to the Texas Gun Rights Foundation Legacy Society, and assure that your philanthropic intentions will be respected and fulfilled!